Looking for the best Personal Loan deal for you?

What size loan do you require?

For how many months?

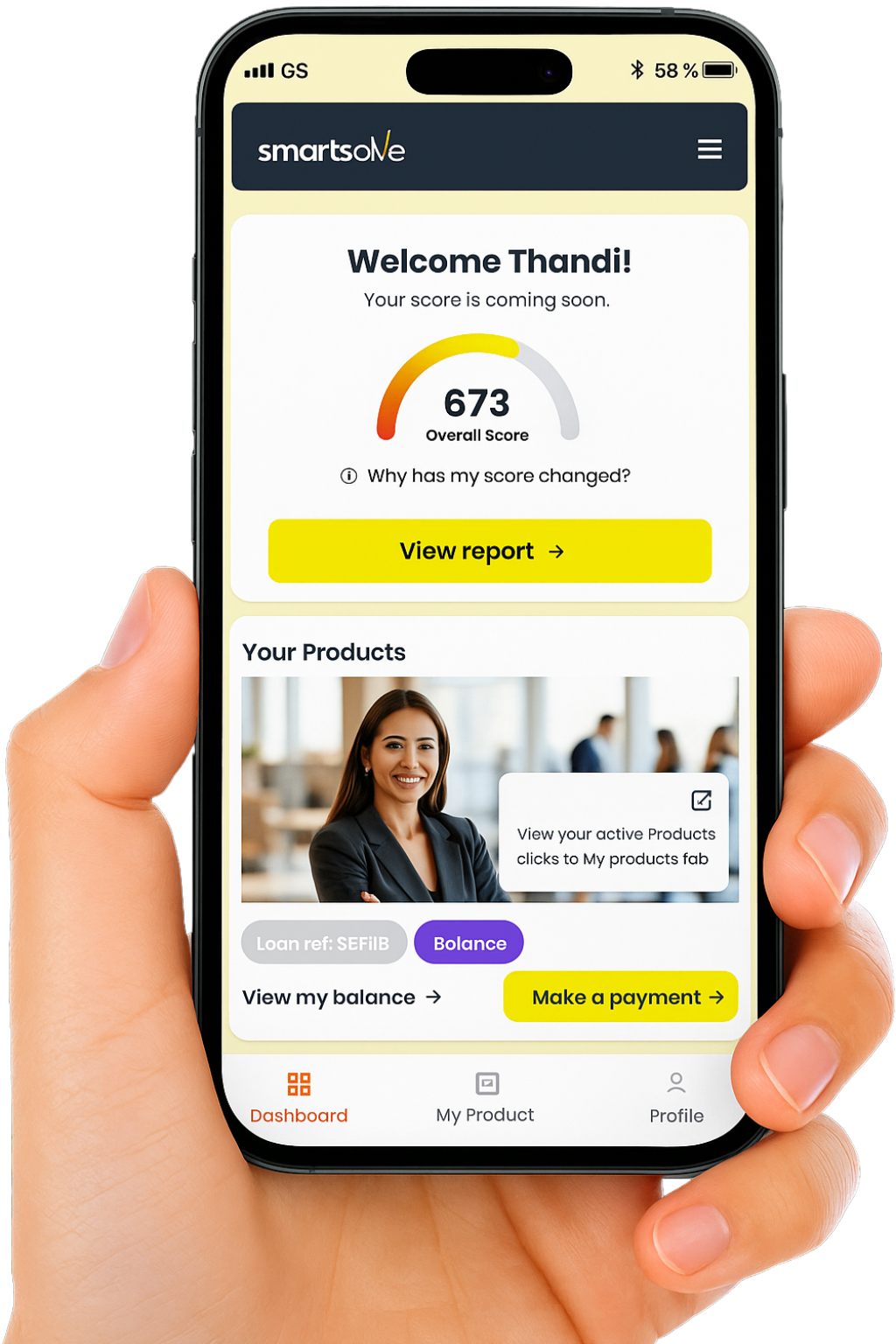

SmartSolve securely connects to your accounts to give a clear picture of your finances and help you lead a healthier financial life.

Select Login or Get a Loan now and enter your ID number and cell phone number.

Enter the OTP or perform facial recognition.

Tell us a little about yourself, and receive a no-obligation quote in a few minutes.

Submit some supporting documents and Contract with us.

We validate the documents and you approve the DebiCheck mandate via your bank.

Funds disbursed into your bank account typically within 48hrs.

Create an account and get access to your Credit Score and custom offers tailored to your needs

Frequently Asked Questions

Based on questions Customers have previously asked us, we have provided the answers to help YOU.

Who can apply for a short-term personal loan with SmartSolve Finance?

You can apply if you are: A South African identity document holder 18 years or older currently employed, and able to supply three months' worth of bank statements and your latest payslip.

What can I do with a short-term personal loan?

Whether you need cash to cover urgent car repairs, unexpected medical expenses, or a temporary gap in your finances, a short-term loan can help. How you use the money is up to you.

What is an unsecured short-term personal loan?

With an unsecured loan, you don’t need an asset or collateral as security. Unlike some loans, which require you to risk an asset, unsecured loan approval is based on your creditworthiness and loan affordability.

How can I apply for a short-term personal loan?

Apply online in less than 3 minutes. Click ‘Get a Loan now’ and make sure you have the following documents ready: Your original identity document or smart identity card Your latest three months’ bank statements Your latest payslip.

Can I get a loan with a poor or no credit score?

We use your credit profile to determine whether you qualify for a personal loan. A poor credit score – or no credit history at all – may mean your loan application is less likely to be approved.

Are there any upfront costs?

SmartSolve Finance will never ask you for any upfront fees to secure a loan. This is illegal in terms of the National Credit Act.